Corporate Governance

Mazda respects the intent of the Corporate Governance Code set by the Tokyo Stock Exchange and, while working to build a good relationship with its stakeholders, including shareholders, customers, suppliers, the local community, and its employees, the Company shall strive to sustain growth and enhance its corporate value over the medium and long terms through transparent, fair, prompt, and decisive decision-making and to continue to enhance its corporate governance.

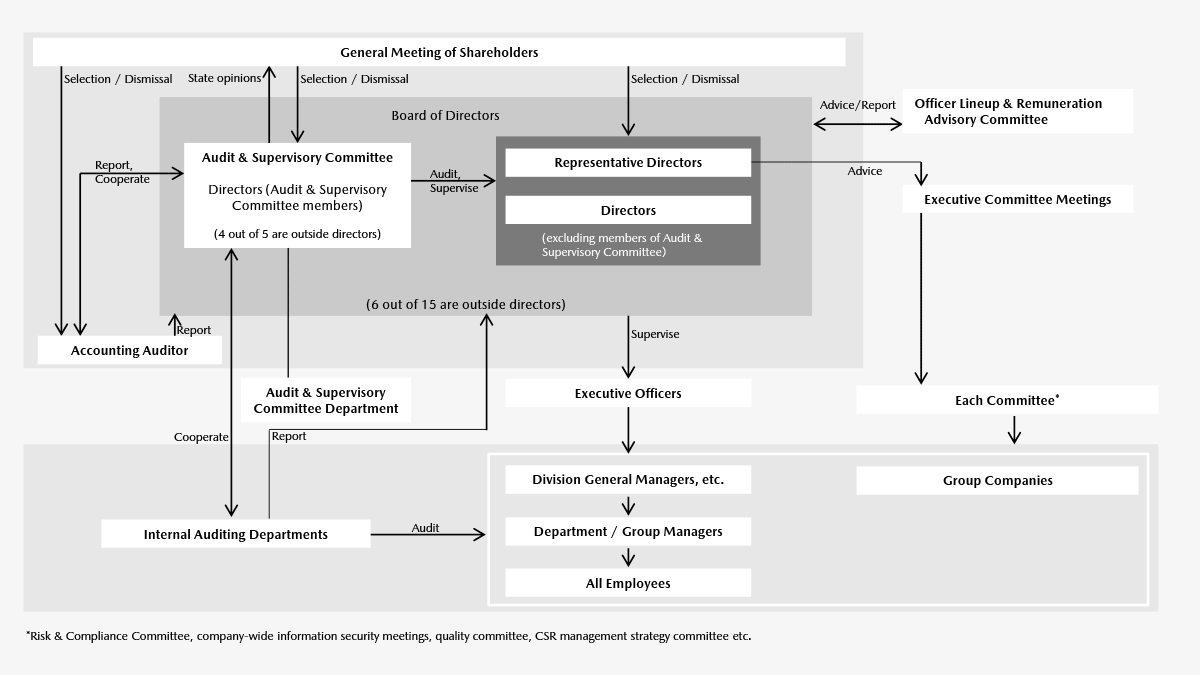

The corporate governance structure on this page is the structure after the General Meeting of Shareholders held on June 27, 2023.

Corporate Governance Framework

Overview of Corporate Governance System

The Company’s surrounding business environment is undergoing rapid changes. To enable faster business decision-making, further enhance discussion of management strategies and strengthen supervisory functions of board of directors meetings, the Company transitioned to a company with an audit and supervisory committee.

In addition to bodies designated by law such as the General Meeting of Shareholders, board of directors, and the Audit & Supervisory Committee, the Company holds executive committee meetings to convey information necessary for debate on important company-wide policies and initiatives and business management, as well as advisory bodies that contribute to decision-making by the board of directors or the president.

Board of Directors

The Company’s board of directors deliberates and makes decisions on items related to the execution of important business, such as management strategy and basic management policies, and supervises the execution of individual directors’ duties. In addition, facilitate quick and flexible decision-making, based on the Articles of Incorporation a substantial part of decision-making regarding the execution of important business will be delegated to management, and executive directors including and below the president to whom authority has been delegated based on the Company’s rules of administrative authority will make decisions regarding these matters. The board is made up of 15 directors, six of whom are highly independent outside directors. The board of directors generally meets once per month.

Audit & Supervisory Committee

The Company’s Audit & Supervisory Committee audits the board of directors’ decision-making process and business execution through the execution of voting rights at board of directors meetings and the execution of its right to state opinions on the personnel changes and remuneration of directors (excluding directors who are Audit & Supervisory Committee Members) at the General Meeting of Shareholders. The Audit & Supervisory Committee is made up of five members, four of whom are highly independent outside directors. To ensure the smooth operation of the Audit & Supervisory Committee’s audits, one of its members are fulltime.

Executive Officer System

The Company has also introduced an executive officer system. By separating execution and management, the effectiveness of the oversight of the board of directors is enhanced, and decision-making is speeded up through expanded debate by the board of directors and by delegating authority to executive officers. In this way, the Company is working to further managerial efficiency.

Officer Lineup & Remuneration Advisory Committee

The Company established the Officer Lineup & Remuneration Advisory Committee, made up of three representative directors and six outside directors and chaired by a representative director, as an advisory body to the board of directors. The committee reports to the board of directors the results of its deliberation on matters such as officer lineup and policies regarding the selection and training of directors, as well as remuneration payment policies and the remuneration system and process based on those policies, which contribute to the Company’s sustainable growth and raising of corporate value in the medium and long term.

Executive Committee Meetings

The Company established executive committee meetings to report information necessary for debate on important company-wide policies and initiatives.

Internal Audits

The Global Audit Department (26 full-time staff) conducts audit functioning as the Company’s internal Audit Department in an effort to contribute to sound and efficient management, and it audits the appropriateness of the business activities of the Company and its affiliated companies with regard to managerial targets, policies and plans as well as laws and regulations. It also audits the appropriateness and effectiveness of internal control.

Accounting Audits

Accounting audits are conducted by KPMG Azsa LLC, with whom the Company has concluded an audit contract. The certified public accounts who conducted the Company’s accounting audits are Hiroshi Tawara, Koji Yoshida and Takuya Morishima who are employed by KPMG Azsa. Those assisting with the Company’s accounting audits include 13 certified public accountants, one public accountants with U.S. certification, and 18 others, eight of whom have passed the certified public account examination.

Organizational Affiliation

| Board of Directors (Including members of Audit & Supervisory Committee) |

Number | 15 (Inside Directors: 9, Outside Directors: 6), including 2 female and 1 foreign national directors |

| Ratio of Outside Directors | 40.0% | |

| Ratio of Female Directors | 13.3% | |

| Audit & Supervisory Committee | Number | 5 (Inside Directors: 1, Outside Directors: 4), including 1 female director |

| Officer Lineup & Remuneration Advisory Committee | Number | 9 (Inside Directors: 3, Outside Directors: 6), including 2 female and 1 foreign national directors |

| Ratio of Outside Directors | 66.7% |

Skills Matrix of the Board of Directors

When nominating and appointing candidates for director or executive officers under the basic premise that they are healthy both physically and mentally, the Company will consider their professional and personal achievements, whether they have an appropriate attitude in regard to fulfilling the mandate of shareholders, customers and other stakeholders, high ethical standards, leadership qualities, the ability to take action, and the experience and ability to carry out their duties. In addition, as the business environment surrounding the Company rapidly changes, Mazda believes that the Board of Directors must have an appropriate balance in knowledge, experience and competence and also be diverse in composition to exectively fulfill their roles and responsibilities for the sustainable growth and improvement in corporate value over the medium and long term.

| Organizational affiliation*1 and attendance*3 |

Fields of experience and expertise*2 | |||||||||||||

| Name and attribute |

Job title | Board of Directors |

Audit & Supervisory Committee |

Officer Lineup & Remuneration Advisory Committee |

Management (executive experience) |

Global business |

Product planning / R&D |

Manufacturing / Purchasing / Quality |

Brand / Marketing / Sales |

ESG | IT/DX | HR management / Personnel development |

Legal / Risk management | Finance / Accounting |

| Kiyotaka Shobuda |

Representative Director and Chairman of the Board |

● 17/17 |

● 5/5 |

● | ● | ● | ● | ● | ||||||

| Masahiro Moro |

Representative Director, President and CEO |

○ 17/17 |

○ | ● | ● | ● | ● | ● | ● | |||||

| Jeffrey H. Guyton |

Representative Director, Senior Managing Executive Officer and CFO |

○ | ○ | ● | ● | ● | ● | ● | ||||||

| Mitsuru Ono |

Director and Senior Managing Executive Officer | ○ 16/17 |

● | ● | ● | ● | ● | |||||||

| Yasuhiro Aoyama |

Director and Senior Managing Executive Officer | ○ 17/17 |

● | ● | ● | ● | ||||||||

| Ichiro Hirose |

Director and Senior Managing Executive Officer | ○ 14/14 |

● | ● | ● | |||||||||

| Takeshi Mukai |

Director and Senior Managing Executive Officer | ○ 14/14 |

● | ● | ● | |||||||||

| Takeji Kojima |

Director, Senior Managing Executive Officer and CSO |

○ | ● | ● | ● | |||||||||

| Kiyoshi Sato Independent /Outside |

Director | ○ 17/17 |

○ 5/5 |

● | ● | ● | ● | ● | ||||||

| Michiko Ogawa Independent /Outside |

Director | ○ 17/17 |

○ 5/5 |

● | ● | ● | ||||||||

| Nobuhiko Watabe |

Director Audit & Supervisory Committee Member (full-time) |

○ 17/17 |

● 19/19 |

● | ● | ● | ● | |||||||

| Akira Kitamura Independent /Outside |

Director Audit & Supervisory Committee Member |

○ 16/17 |

○ 19/19 |

○ 5/5 |

● | ● | ● | |||||||

| Hiroko Shibasaki Independent /Outside |

Director Audit & Supervisory Committee Member |

○ 17/17 |

○ 18/19 |

○ 5/5 |

● | ● | ||||||||

| Masato Sugimori Independent /Outside |

Director Audit & Supervisory Committee Member |

○ 17/17 |

○ 18/19 |

○ 5/5 |

● | ● | ● | ● | ● | |||||

| Hiroshi Inoue Independent /Outside |

Director Audit & Supervisory Committee Member |

○ | ○ | ○ | ● | ● | ● | |||||||

- *1 ● in the “Organizational affiliation” column shows the person's status as chairperson.

- *2 The “Fields of experience and expertise” column only shows each person's major fields of experience and expertise, instead of providing complete information.

- *3 Attendance record of Mr. Ichiro Hirose and Mr. Takeshi Mukai covers the period after they assumed their posts on June 24, 2022. Attendance record of Mr. Jeffrey H. Guyton, Mr. Takeji Kojima, and Mr. Hiroshi Inoue is not stated since they assumed their posts on June 27, 2023.

Analysis and evaluation of the board’s effectiveness

To steadily advance measures for the further enhancement of its efficiency, the Company’s board of directors analyzed and evaluated the meetings conducted in fiscal 2022.

The method and results are outlined below.

- i. Method of analysis and evaluation

- Based on a survey prepared by the board’s secretariat, all of the directors evaluated the board’s effectiveness. After the results were compiled by the secretariat, an analysis of the current situation was shared at a board meeting, and the principles to be pursued and improvements were discussed.

The survey primarily covered the constitution of Board of Directors, debate on the business strategy, debate on compliance and internal control, provision of information (the amount of information, materials, explanations and support for outside directors) and involvement in the debate.

Additionally, the effects of accelerating management’s decision-making, further enhancing deliberation of the board of directors, and strengthening the supervisory function of the Board of Directors, which were the objectives of the transition to a company with an audit & supervisory committee, were confirmed.

- ii. Overview of results

- It was found that members of the board of directors are properly involved in determining the Company’s business strategy and share an understanding of its content, that the outside directors express their opinions from an independent perspective after gaining an understanding of the Company’s situation by receiving explanations of resolutions in advance and other forms of support, and that the oversight function of the execution of operations has been ensured.

Furthermore, as there has been progress in delegation of the Board of Directors’ authorities to representative directors within the appropriate scope under the Company’s Articles of Incorporation, improvement in the speed of decision-making and improvement in the productivity of discussions resulting from securing ample discussion time were confirmed. At the same time, for the Company to achieve full-scale growth steadily in the future as the surrounding business environment grows more severe and remains uncertain, all directors confirmed that it is necessary to continue to strengthen the monitoring of key business areas including the management strategy, identify changes as early as possible, and discuss risks and profitability from a wide range of perspectives.

The Company will analyze and evaluate the effectiveness of the Board of Directors every year and continue initiatives for constant improvement to raise corporate value in the medium to long term.

Reasons for Appointment of Outside Directors

[Outside Directors] These directors are anticipated to enhance the supervisory functions of the Board of Directors through their efforts, in addition to leveraging the following experience and insight in the management of the Company.

| Name | Reasons for Appointment |

| Kiyoshi Sato | Mr. Sato has rich expertise in the areas of sales and marketing at an electronics manufacturer. He has served in senior roles, such as representative director, president and CEO, and director and vice chairman of the board, and has rich experience and insight in corporate management. We expect his advice and recommendations from an international perspective and his broad management viewpoint in particular. |

| Michiko Ogawa | Ms. Ogawa has detailed knowledge as an audio technology researcher at an electronics manufacturer. As an officer in charge of premium audio equipment, she engaged in brand reestablishment efforts and possesses rich experience and insight into corporate management. We expect her advice and recommendations from a brand marketing perspective and her professional viewpoint as an engineer in particular. |

[Outside Directors (Audit & Supervisory Committee Members)] These directors are anticipated to strengthen the audit and supervisory functions of the Company's management through their efforts by leveraging the following experience and insight.

| Name | Reasons for Appointment |

| Akira Kitamura | Mr. Kitamura has held key posts at a financial institution, including representative director & senior managing executive officer as well as chairman of the board and chief executive officer (representative director). He has great knowledge of finance and accounting and rich experience in and knowledge of corporate management. We expect his advice and recommendations from the broad viewpoint of corporate management and from his expert understanding of finance and accounting in particular. |

| Hiroko Shibasaki | Ms. Shibasaki has many years of experience in the field of sales at a damage insurance company. In roles such as managing executive officer, she oversaw sales in Kyushu and Okinawa and gained rich experience and insight into corporate management. We expect her advice and recommendations from the standpoint of customer satisfaction and from her expert knowledge of sales in particular. |

| Masato Sugimori | Mr. Sugimoto has worked in administration for many years at a trading company and has considerable knowledge of risk management, finance, and accounting. He has also served as a senior managing executive officer with experience in and insight into corporate management. We expect his advice and recommendations from the broad viewpoint of risk management and from his expert understanding of finance and accounting in particular. |

| Hiroshi Inoue | Mr. Inoue served as a prosecutor and attorney for many years, and has extensive experience in and knowledge of the legal profession. We expect his advice and recommendations from the viewpoint of compliance and from his expert standpoint as a legal professional in particular. |

Criteria for determining the independence of outside officers

Outside directors are deemed to be independent if they fulfill the requirements outlined below.

- The person is not an executive or former employee of the Company's group (*1) and no close family member (*2) is currently an executive of the Company's group or has been an executive of the Company's group within the past three years.

- The person is not now nor has been within the last three years any of the following:

- (i) An executive at a major shareholder (*3) of the Company

- (ii) An executive at a company for whom the Company is a major business partner (*4) or a major business partner of the Company (*5)

- (iii) A person affiliated with the auditing firm that serves as the Company's accounting auditor

- (iv) A lawyer, certified public accountant, tax accountant or other consultant who receives a large sum of money from the Company for something other than director remuneration (*6) (if the person receiving the money is a corporation or other organization, a person affiliated with the organization)

- (v) A director, Audit & Supervisory Board Member or executive officer at a company with a director from the Company

- (vi) An executive of an organization receiving large donations or aid from the Company (*7)

- None of 2.(i) through (vi) above (important posts only) apply to any close family member of the person

- *1 The Company or its subsidiaries

- *2 Spouse or a family member within the second degree of kinship

- *3 A shareholder holding 10 percent or more of the Company's voting rights at the end of the fiscal year

- *4 A business partner to whom 2 percent or more of consolidated net sales in recent fiscal years has been paid by the Company

- *5 A business partner by whom 2 percent or more of the Company's consolidated net sales in recent fiscal years have been paid or a financial institution that has provided loans for 2 percent or more of the Company's consolidated assets

- *6 Money other than officer remuneration received from the Company or property benefits that exceed 10 million yen a year

- *7 An organization that received donations or aid exceeding 10 million yen per year

Dialogue with Shareholders and Investors

For continued growth and enhancement of corporate value over the medium and long terms, the Company promotes investor relations through the timely and appropriate disclosure of information to shareholders and investors and through constructive dialogue.

As methods of dialogue, the Company holds quarterly briefings on financial results including at general meetings of shareholders to explain business conditions and business activities. In addition, the Company holds business briefings for securities analysts, institutional investors and individual investors. The Company endeavors to disclose information in a timely manner by posting notices of the convocation of general meetings of shareholders, financial results information, the Medium-Term Management Plan,

securities reports and other company information of interest on the Company website. The Company is also considering providing broader disclosure regarding dialogue with shareholders. The officer who oversees finance will have overall responsibility for dialogue with shareholders under CEO and CFO’s leadership, and the officer in charge of finance and the financial planning department (investor relations department) will be in charge. To enhance dialogue, they will cooperate with departments in charge, including the Corporate Planning & Development Division, the Corporate Communications Division and the Corporate Services Division, and create a framework for the proper provision of information. Opinions from shareholders will be relayed to the board of directors or the management team as necessary by the officer who oversees finances.

Results of Main IR Events and Dialogues in FY March 2023

| Event | Number | Main Attendees from Mazda |

|---|---|---|

| Financial Results Briefing | 4 | Representative Director, President and CEO, Director and Senior Managing Executive Officer |

| Medium-term Management Plan Announcement | 1 | Representative Director, President and CEO, Director and Senior Managing Executive Officer |

| Briefing for Individual Investors | 2 | Managing Executive Officer |

| Participation in Conferences organized by Securities Firms | 3 | Director and Senior Managing Executive Officer, Managing Executive Officer |

| Dialogues | Number | Main Attendees from Mazda |

| Dialogues with Investors | 130 | Representative Director, President and CEO, Director and Senior Managing Executive Officer, Managing Executive Officer, IR Group |

| Dialogues with Analysts | 80 | Director and Senior Managing Executive Officer, Managing Executive Officer, IR Group |

Main Themes and Topics Discussed in Dialogues

Recent Financial Results

- Status of procurement of semiconductors, Impact on production

- Impact of hikes in raw material prices, Improvement of per-unit prices

- Industry demand and sales performance in key markets

- Launches of Large models and other new models

Medium and Long-term Strategies and Initiatives

- Progress of Medium-term Management Plan initiatives

- Initiatives for electrification and carbon neutrality

- Plan of EV launches, Alliance with partners

Other

- Operation at our plant in the US

- Returns to shareholders, Capital policy

Cross-Shareholdings

- i. Policy on cross-shareholdings

- Taking into overall consideration the business strategy, the necessity of business activities such as maintaining and strengthening business dealings, and the comparison of benefits and risks of cross-shareholding with the cost of capital, the Company will have cross-shareholdings when it will lead to the enhancement of corporate value over the medium and long terms. If the purpose of cross-shareholdings is judged to have diminished, the Company will aim to reduce cross-shareholdings, including the selling of shares based on the relevant company’s circumstances, etc.

- ii. Verification by the board of directors

- Every year at a board of directors meeting, the Company will individually verify the appropriateness of its cross-shareholdings according to the above policy.

Stocks held as of the end of March 2023 were verified at a board of directors meeting, and the rationality of those holdings was confirmed.

- iii. Basic policy on exercise of voting rights

- When exercising its right to vote for cross-shareholdings, the Company will comprehensively evaluate whether or not matters that have come up for a vote will contribute to enhancing the corporate value, etc., of the Company and companies in which the Company holds shares over the medium and long terms; the Company will then decide whether to vote for or against any proposals.

Basic Views on Eliminating Anti-Social Forces

The Mazda Group will have no connection with anti-social forces or groups nor carry out any acts to facilitate the activities of such forces or groups. In the event of unreasonable demands from anti-social forces or groups, these will be dealt with firmly, including systematic efforts in cooperation with external bodies such as the police or lawyers as necessary.